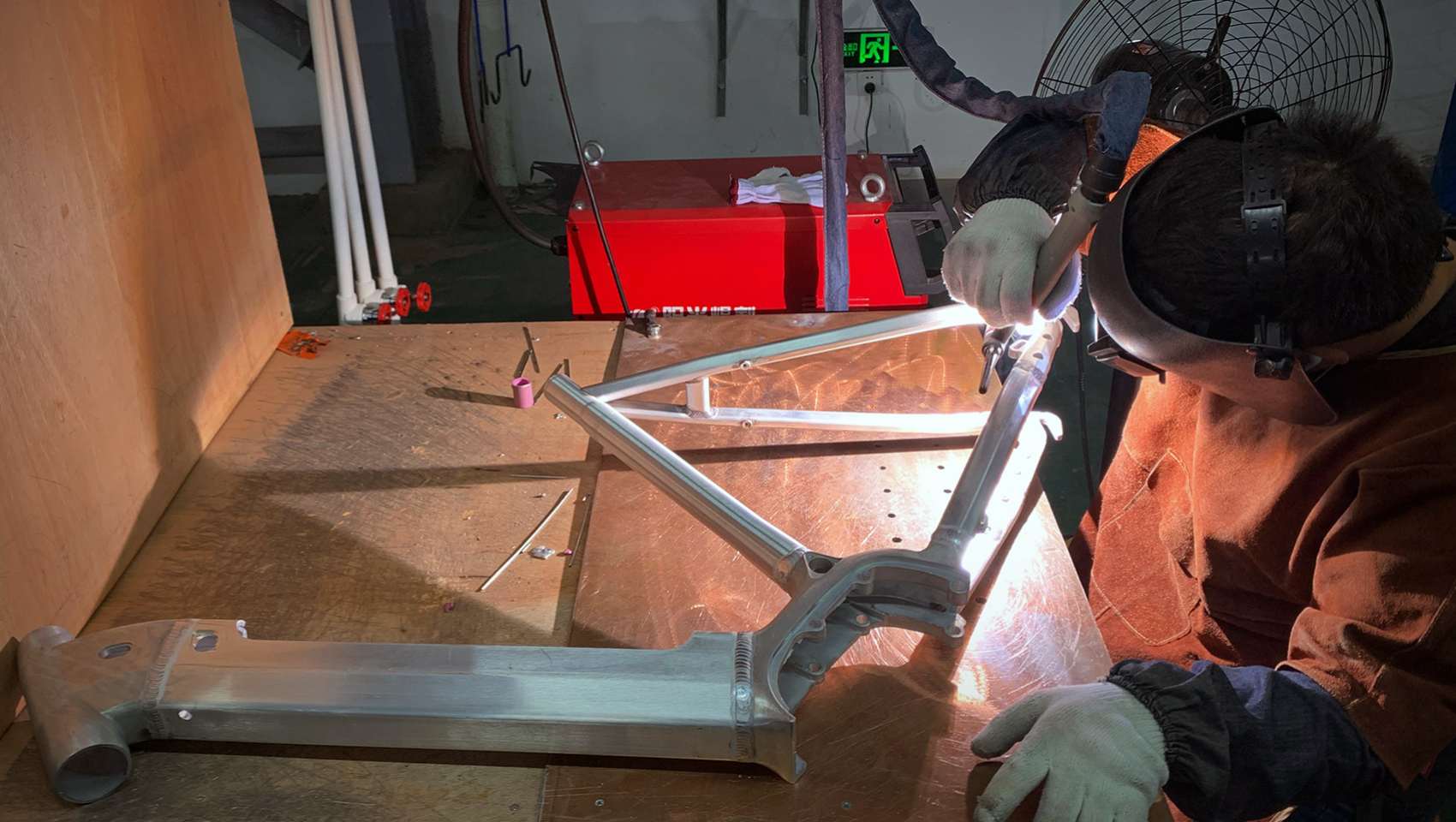

To ease the company’s supply chain and to be less dependent on external suppliers, a new frame building factory has been set up in China by the owner of Timyo e-bikes. “This year lead-times got completely out of control due to COVID-19. We decided to take matters into our own hands and establish our own frame building,” explains Nantong Dingyu Vehicle Industry CO. LTD CEO Steve Zhu. This autumn the first series were already made.

Read more

Today Timyo operates two e-bike assembly plants in Europe, one in the Netherlands and one in Lithuania. After the implementation of the anti-dumping duties in 2019 the facility in China is only used for pre-production planning and storage. Earlier this year, Timyo’s owner Nantong Dingyu Vehicle Industry CO. LTD founded a new subsidiary; the Dingyu frame factory which is based just north of Shanghai. Since this summer the new frame factory is also located on the same premises.

Investment in robotised production

“To avoid complicated welding, we decided to use gravity die casting and invested substantially in robotised production. The big advantage of gravity die casting is that you need only 5 welds to build a complete e-bike frame with the same characteristics and riding features as a hydroformed frame. Our robotised welding machines can weld two frames at the same time,” explains CEO Steve Zhu.

“A second reason for us to go for die casting instead of hydroformed frames is the wide availability in the areas where we are based. The automotive industry is widely spread over this region. If we would have chosen for hydroformed frames we would have ended up at Giant China. That’s not what we preferred as it was our intention to be less dependent on the regular bicycle supply chain. We had to go up stream in the supply chain to make a real difference and that’s what we did with our choice for die casting.”

To obtain maximum control over the production process, the Dingyu frame factory includes a T4 and T6 heat treatment facility while the new painting line is still under construction. This comes with the latest powder coating and wet-based painting technology.

Fixed platforms

The establishment of the frame building factory is not only a matter of keeping control over production, but also to streamline the whole process. Steve explains that they “developed a high-end in-tube die casting frame with a fixed platform for Bosch, Shimano and Bafang. By limiting the number of weldings to only 5 we can reduce the time needed for engineering and R&D by 50% compared with a regular e-bike frame.

Output and expansion

“We want to do everything ourselves when it comes to frame building,” says Steve Zhu. “The total capacity of the machinery is 150,000 units annually while in floorspace the total output can be scaled to 250,000 units. We use the output of our frame factory only partially to our sister companies in the group who distribute the brands Keola, Muon and Van Dijck. The remaining capacity, now more than 100,000 units is available for others in the market.”

Although the group expects to sell between 30,000 and 45,000 e-bikes this year, the capacity of the Dingyu frame factory matches the expansion strategy of the company. “In 6 to 8 years we expect to distribute all 150,000 e-bikes ourselves, but the market is very unpredictable at the moment.”

“We have learned in 2003 that the SARS pandemic was disruptive for the e-scooter market and the same is happening now with e-bikes. Until 2003 some 0.5 million e-scooters were sold annually in China. In 2003 that volume quickly increased to 10 million and we now stand at 50 million units per year. Still, I have been careful when planning the capacity of our e-bike frame factory.”

“In 2003 the e-scooter market could expand so massively as the industry had a well-organised supply chain, unlike the e-bike industry today. For example, many suppliers of the e-scooter industry have robotised production. Many in the e-bike industry are only starting to implement automated manufacturing. Therefore, key component manufacturers in e-bikes have to expand their capacity otherwise the expansion of this industry will be limited.”

Production location

Investment in robotised production For Dingyu it was no question to put up the factory in another location than the existing factory. “We are nearby China’s biggest hub for the automotive industry with many companies around us offering die casting products. This gives us the possibility to use the over-capacity of the automotive industry. That was also the reason why we did not put up this factory in Europe, close to our main markets. Moving robotised production lines to another location is not the problem, but you need guaranteed access to a highly efficient supply chain. That’s not available everywhere and which makes it so difficult to bring your production to another area unless your volumes are very big,” Steve Zhu concludes.

About Timyo

Nantong Dingyu Vehicle Industry CO. LTD founded Timyo’s to handle all distribution in Europe. Timyo’s main market is until now the Benelux, while distribution has also started in Germany, France and Denmark. A major growth category in these and several other countries is the cargobike. In the company’s brand portfolio Muon is the latest addition, next to the existing labels Keola and Van Dijck. Muon has entered the market as a high-end sports bike for all ages with a strong focus on frame design.

_w1700_h960_1.jpg)